18. depreciation formula for sumoftheyearsdigits YouTube

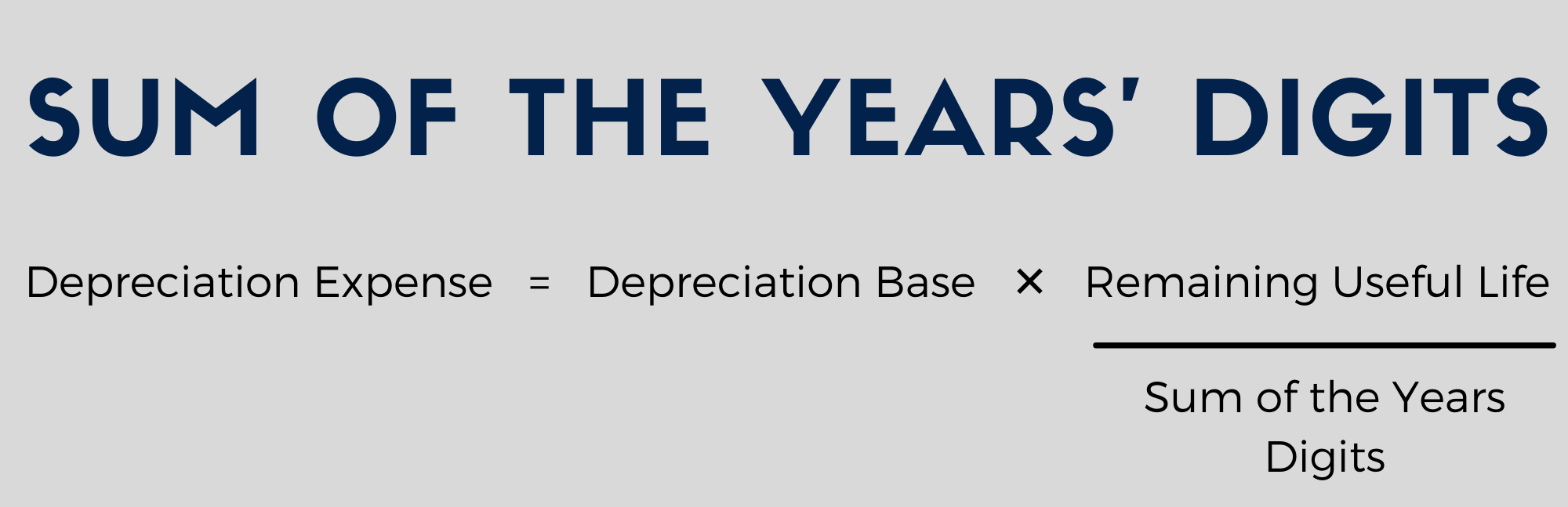

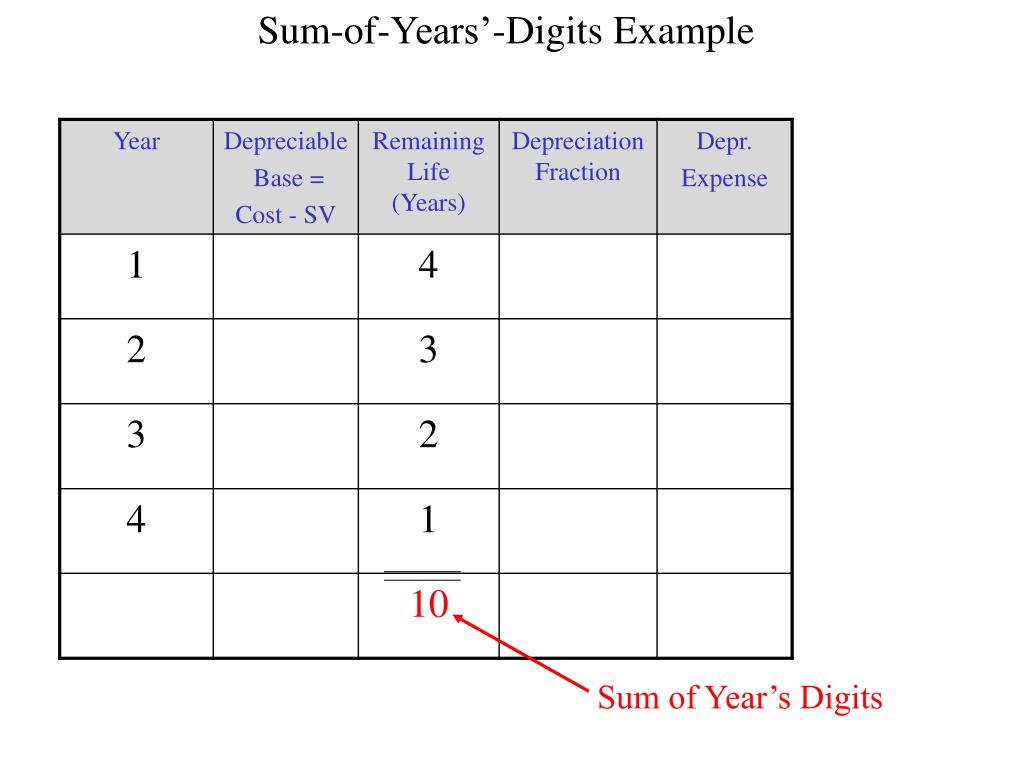

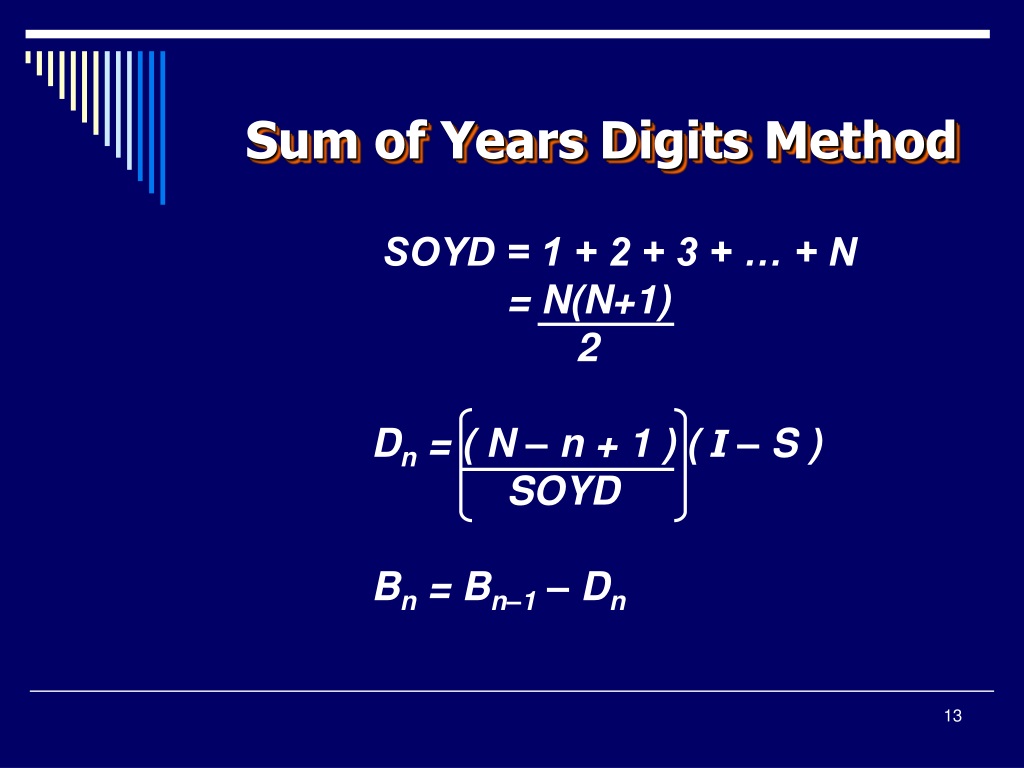

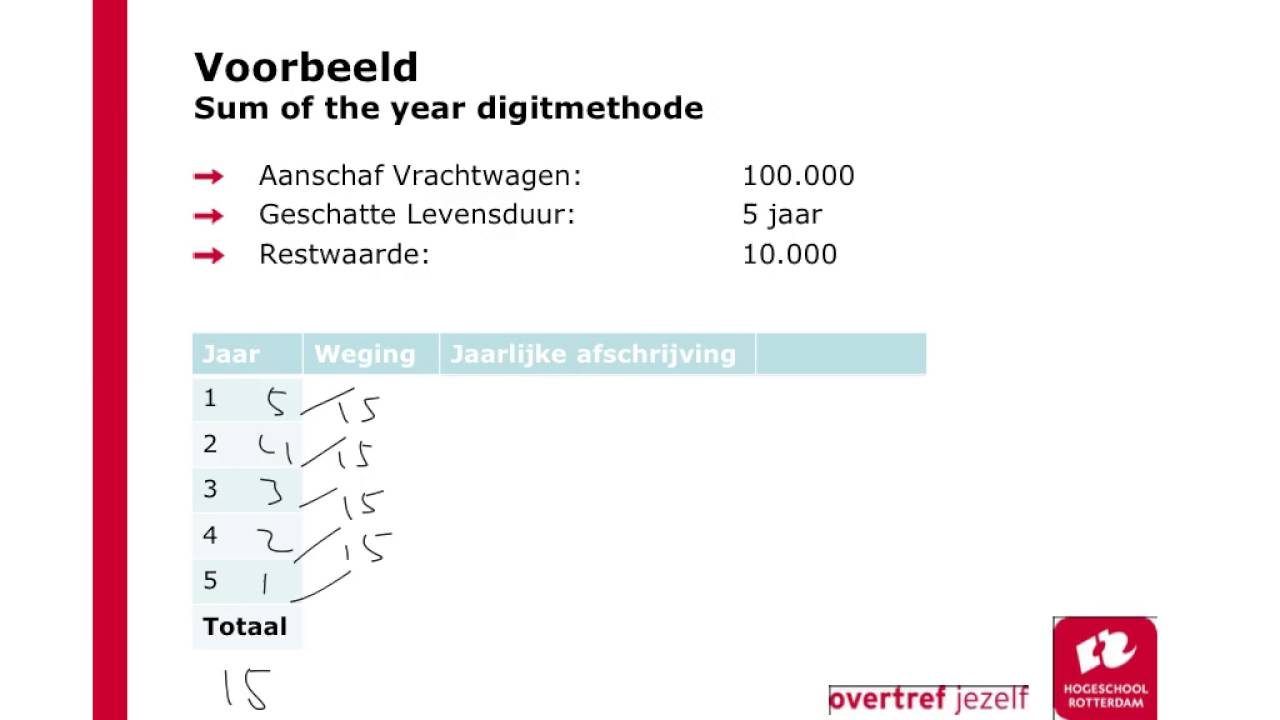

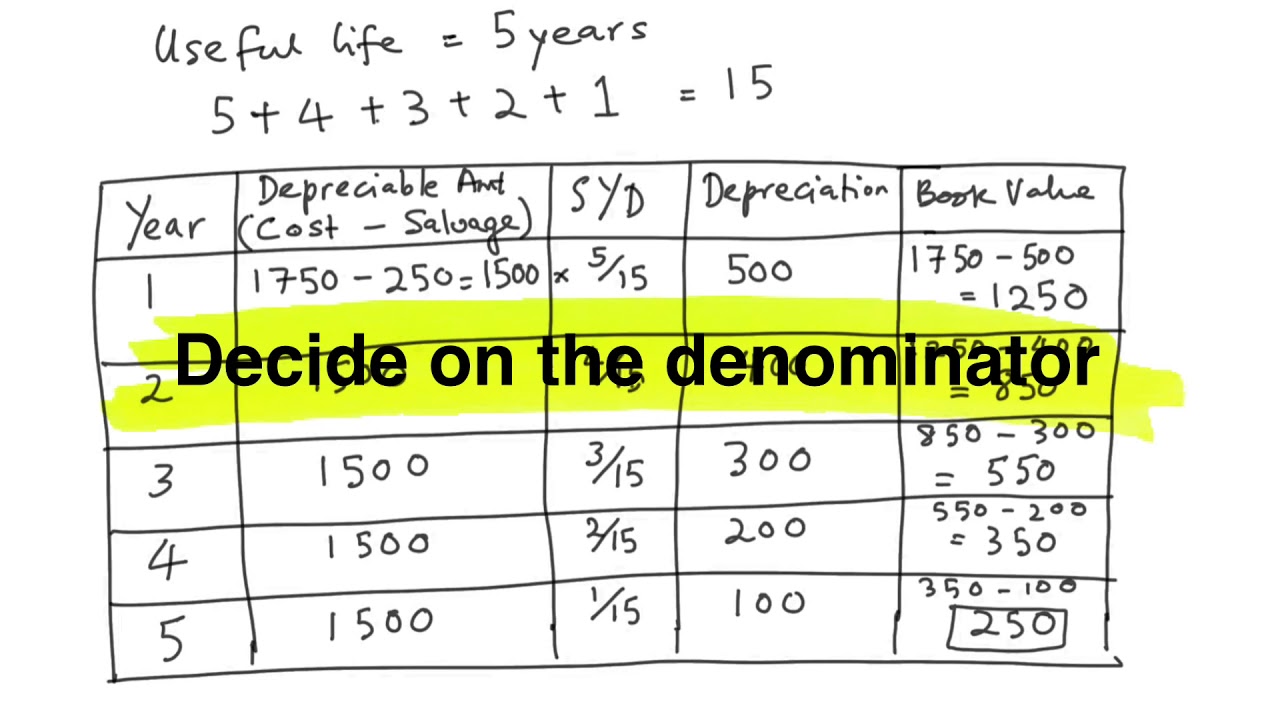

Step 1: Calculate the Sum of the Years' Digits The sum of years' digits is simply an addition of all numbers between zero and the number of years of an asset's useful life. For example, if an asset has a useful life of 5 years, the sum of its years' digits will equal 15 (1 + 2 + 3 + 4 + 5).

:max_bytes(150000):strip_icc()/Sum-of-the-years-digits-4188390-primary-final-b5aa6b9fc28a4ba2b1f04d06672b9b20.png)

SumoftheYears' Digits Definition and How to Calculate

Sum of Years Digits Depreciation Calculator Calculator Use Use this calculator to calculate an accelerated depreciation using the sum of years digits method. Depreciation is taken as a fractional part of a sum of all the years. Create and print schedules. Inputs Asset Cost

Sum of Years' Digits Depreciation Accountingo

If the above formula is used for an asset having a useful life of 10 years, the sum of the digits will be: 10 (10+1)/2 = 10 (11)/2 = 110/2 = 55. In the first year of an asset with a 10-year useful life, the depreciation will be 10/55 of the amount to be depreciated. The second year will use 9/55 and the tenth year will use 1/55.

Sum of the Years Digits YouTube

Sum of the year digits' depreciation is the accelerated accumulated depreciation that counts the salvage value of assets among. Learn more at Accounting play.

Sum of The Year’s Digits Depreciation Model Formula, Examples, Journal Entries

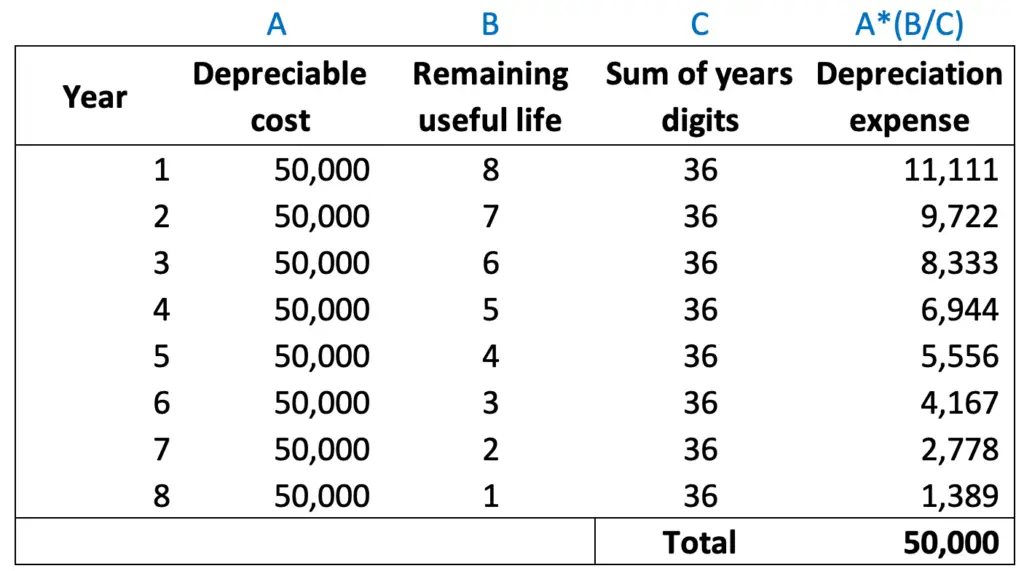

The sum of years digits (SYD) is simply the sum of the year numbers. So for example, if there are 3 years then the sum of years digits is equal to 1+2+3 = 6, if there are 8 years then the SYD is equal to 1+2+3+4+5+6+7+8 = 36. This process can be summarized in the sum of years digits formula as follows: Sum of the years digits = n x (n + 1) / 2.

sumoftheyears'digits method partial year YouTube

Solution: With the information in the example, the company ABC can calculate the sum of years digits depreciation for the machine with the formula as below: Sum of years digits depreciation = (Remaining useful life / Sum of years' digits) x Depreciable cost Sum of years' digits = 8 + 7 + 6 + 5 + 4 + 3 + 2 +1 = 36

Sum of Year Digits Method of Depreciation Calculation Example YouTube

Learn how to depreciate using the sum-of-the-years'-digits method.To download this spreadsheet and follow along with the video, please click here: https://ww.

Sum Of Years Digits Depreciation Concept, Formulas & Solved Problem PMP Exam YouTube

The sum of the years' digits depreciation calculation is: This formula yields the sum of each year of the estimated useful life: 1 + 2 + 3 + 4 + 5 = 15 The sum of the years' digits method is used to accelerate the recognition of depreciation into the first few years of an asset's useful life.

Sum of Years' Digits Depreciation Accountingo

Step 1: Denominator Take each of the years in the asset's useful life and add them together. For example, if an asset has a useful life of 10 years, the total is 55— 10 + 9 + 8 + 7 + 6 + 5+ 4 + 3 + 2 + 1. Hint: the formula N (N+1) / 2 is a quick way to calculate the sum of all numbers from 1 to N.

Calculate sum of the years digits depreciation Example Accountinguide

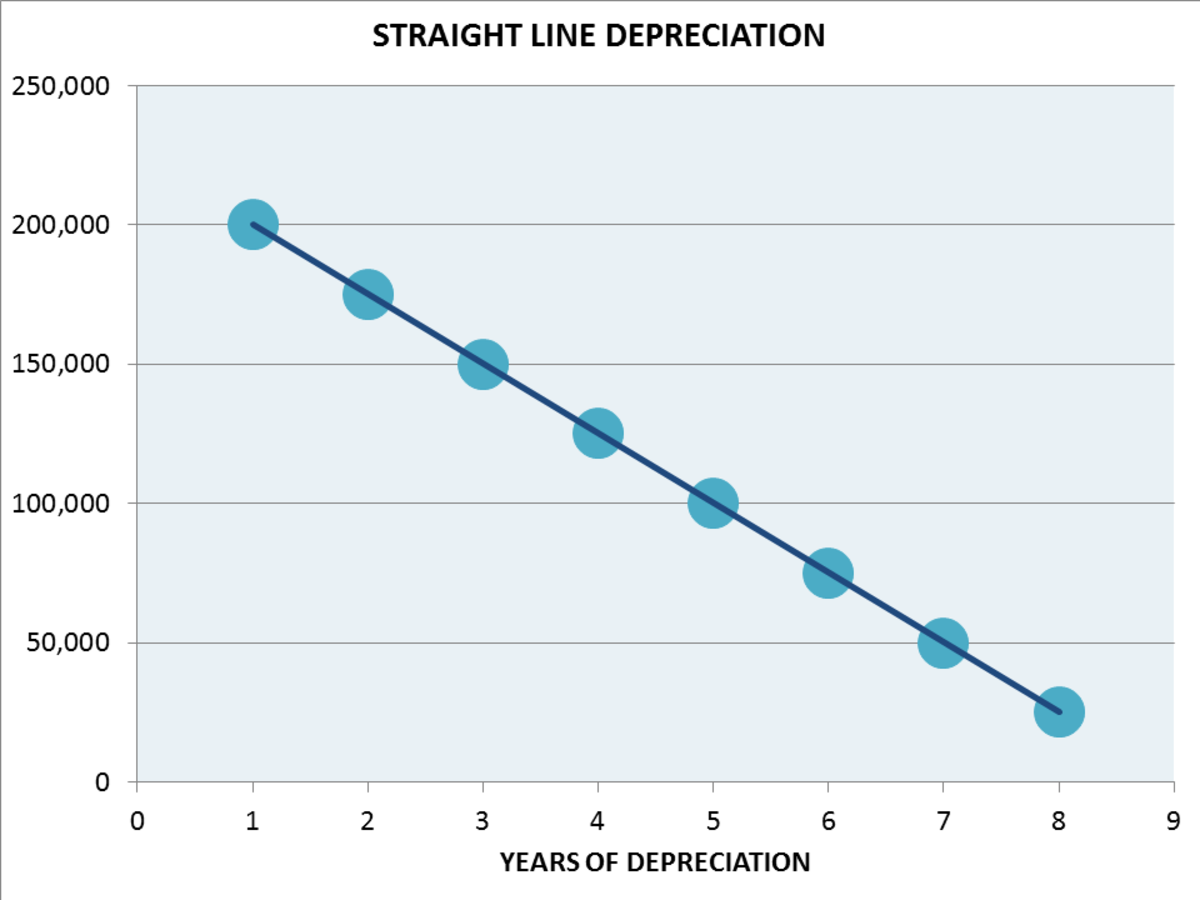

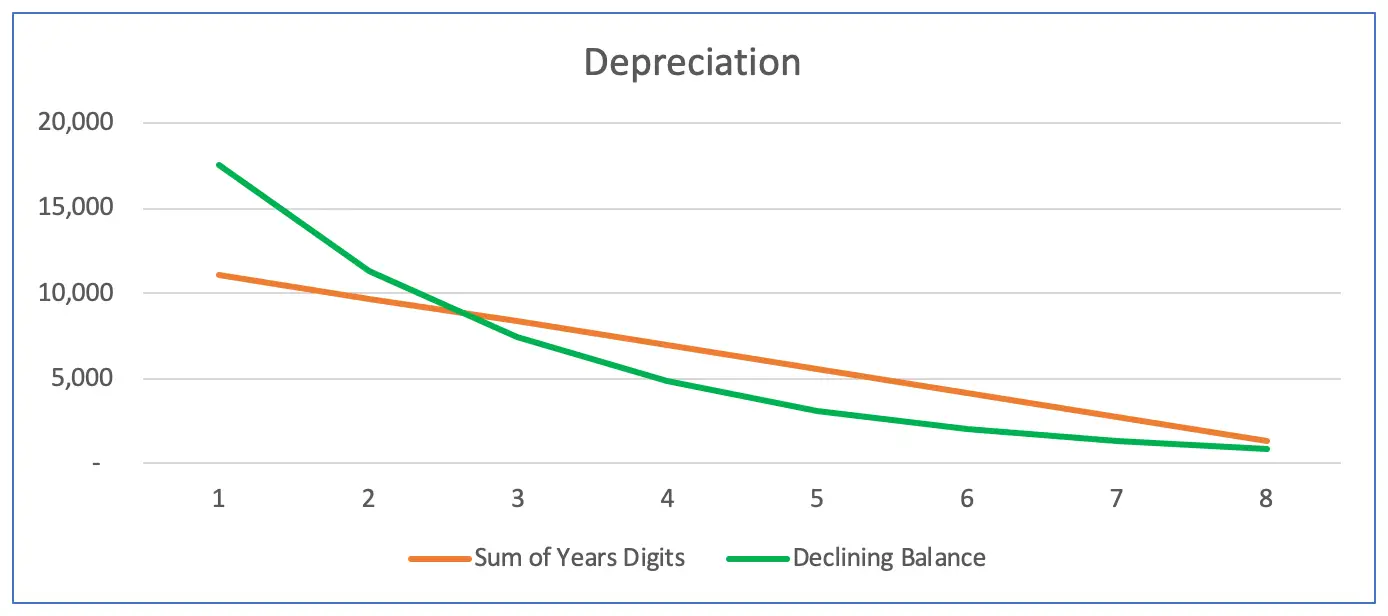

Sum of years Digits Methods or the sum of year depreciation method is an accelerated depreciation method whereby the method declines the asset's value at an accelerated rate. Most of the depreciation of an asset is recognized in the first few years of its useful life.

PPT SumofYears’Digits Example PowerPoint Presentation, free download ID1331389

Low prices on millions of books. Free UK delivery on eligible orders. Browse new releases, best sellers or classics & find your next favourite book

Calculate sum of the years digits depreciation Example Accountinguide

The sum of the years' digits depreciation method accelerates depreciation, to record more depreciation expense earlier in an asset's life.

Sum of Years Digits Depreciation Method YouTube

Step 1: Calculate the sum of the years digits Sum of the years' digits = 3 + 2 + 1 = 6 Step 2: Calculate the depreciable amount Depreciable amount = $100,000 - $10,000 = $90,000 Step 3: Calculate the un-depreciated useful life Step 4: Calculate depreciation expense Year 1: Depreciation expense: Year 2: Depreciation expense:

PPT Depreciation PowerPoint Presentation, free download ID9591902

This video explains the sum-of-the-years'-digits depreciation method, and illustrates how to calculate depreciation expense using the sum-of-the-years'-digit.

B5 Sum of the year digit methode YouTube

Sum-of-the-years' digits (SYD) is an accelerated method for calculating an asset's depreciation. This method takes the asset's expected life and adds together the digits for each year; so if the.

Unit 6 Sum of Year Digit Method for ACCT221 Spring 2020 YouTube

What is the SYD Function (Sum of Years Digits)? The SYD Function is an Excel Financial function. SYD is short for um of ears d igits. This function helps in calculating the depreciation of an asset, specifically the sum-of-years' digits depreciation for a specified period in the lifetime of an asset.